Meta-Insurance System MIS

“Welcome to Meta Insurance System – Your Complete Insurance Solution! Explore our cutting-edge modules, including Profiles, Underwriting, Claims, Reinsurance, Accounting, Security, and more. Simplify policy management, streamline financial processes, and ensure robust security. Elevate your insurance operations with Meta – the epitome of comprehensive and user-friendly insurance software.”

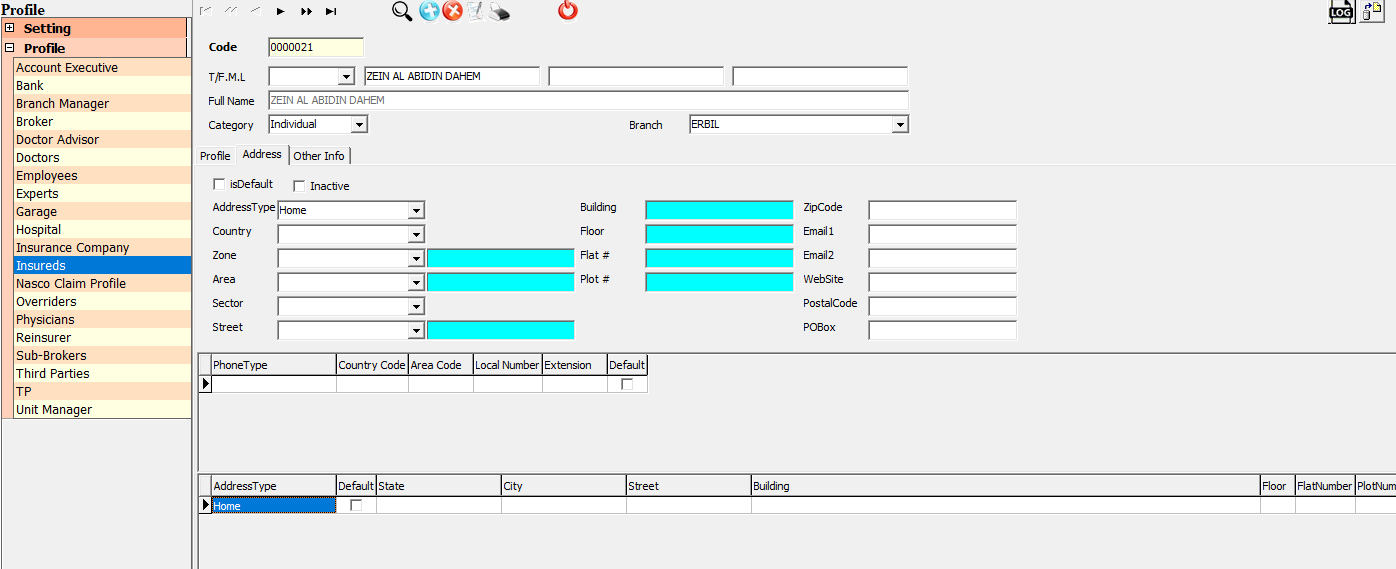

Profiles

Enable users to create diverse profiles with customizable fields such as address, phones, emails, contacts, linked profiles, and electronic files. Our intuitive interface empowers users to manage and update information seamlessly. Each module includes a detailed log file, ensuring transparency and tracking of every user-driven update for enhanced security and accountability.

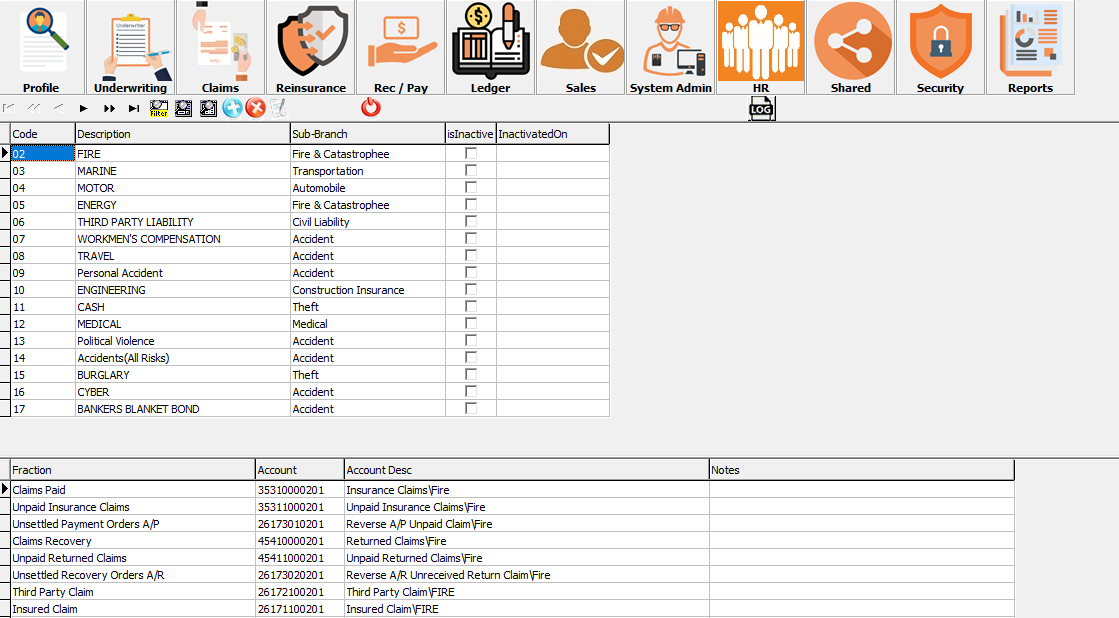

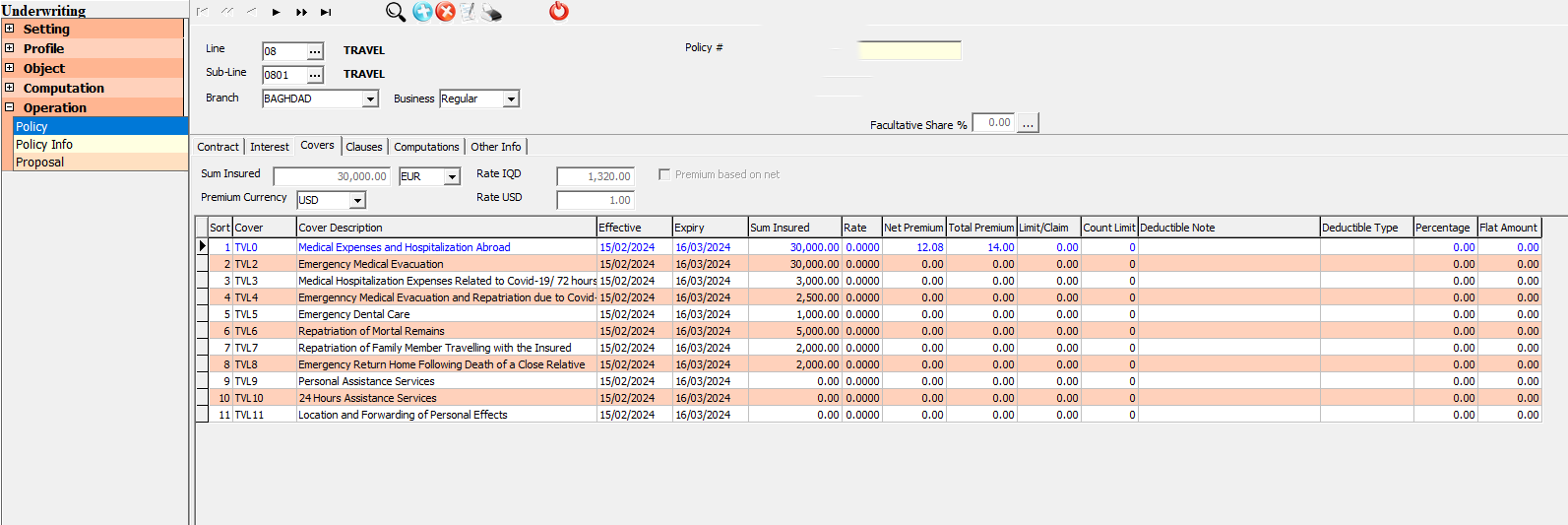

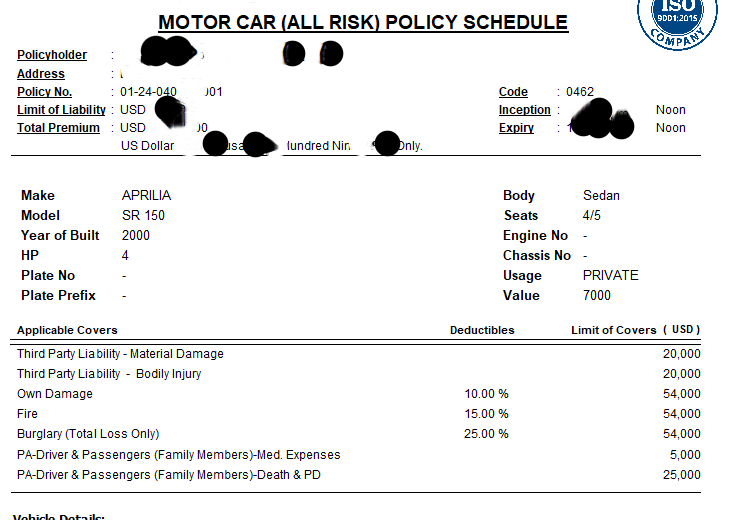

Underwriting

Effortlessly configure policy layouts, lines of business, and covers with customized clauses in our user-friendly underwriting module. Define premium calculations and distribution, set broker commissions, and receive warnings for policy limit exceedance to ensure adherence to treaties. Streamline your underwriting process for a seamless and efficient insurance management experience.

Establish rules to prevent renewing unpaid policies and classify them as Acceptance, Fronting, or Regular. Streamline policy processes by generating closing slips for facultative shares directly from the policy. Additionally, create fleet policies and open cover policies, enhancing flexibility and efficiency in your underwriting operations.

Easily create and manage insurance products in our comprehensive system. Define tariffs for pricing based on pre-defined dimensions of the insured, offering unparalleled flexibility. This module ensures seamless customization and precision in setting prices, allowing for dynamic adjustments to meet the diverse needs of your clients.

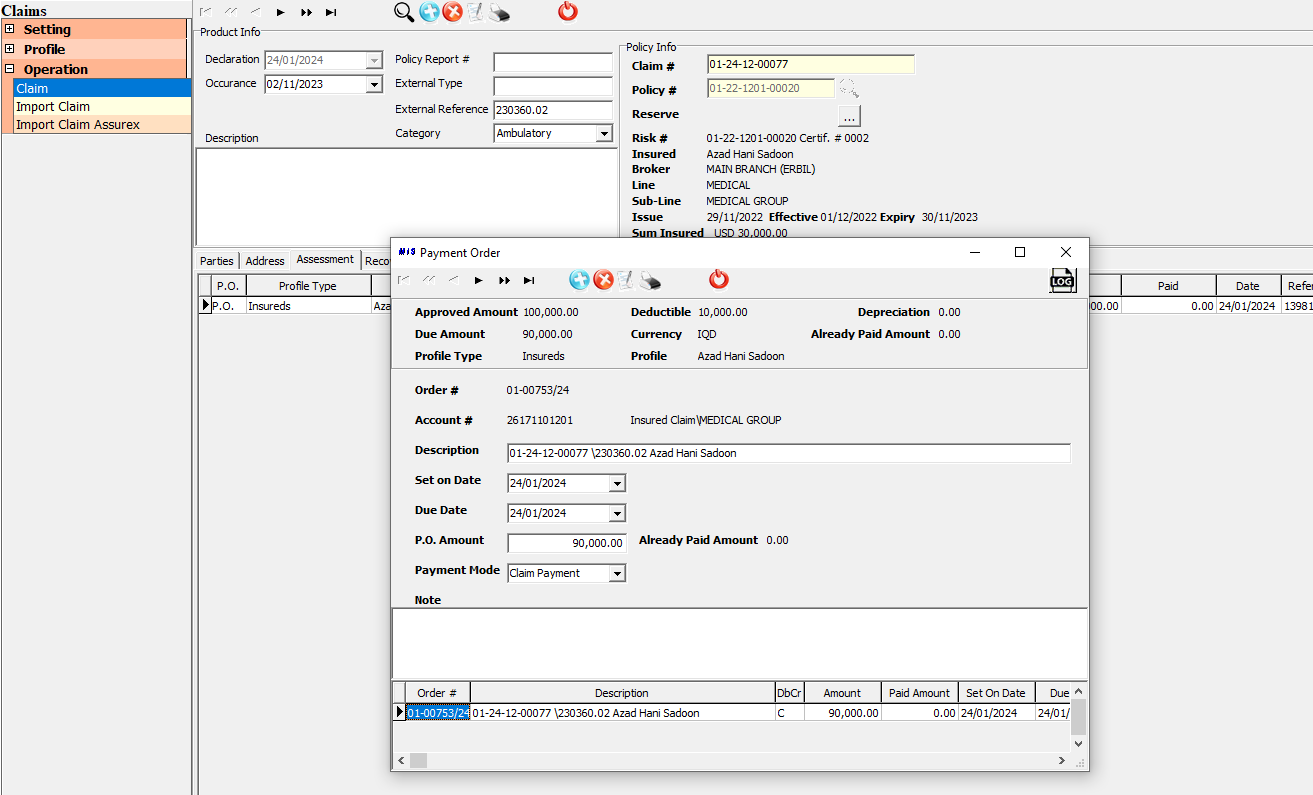

Claims

Record claims exclusively for recorded and active policies in our specialized claims module. Efficiently generate payment orders and recoveries, facilitating seamless handling of outstanding claims. The system automates deductible calculations, preventing users from exceeding cover limits and ensuring precise and secure claims processing for enhanced operational efficiency.

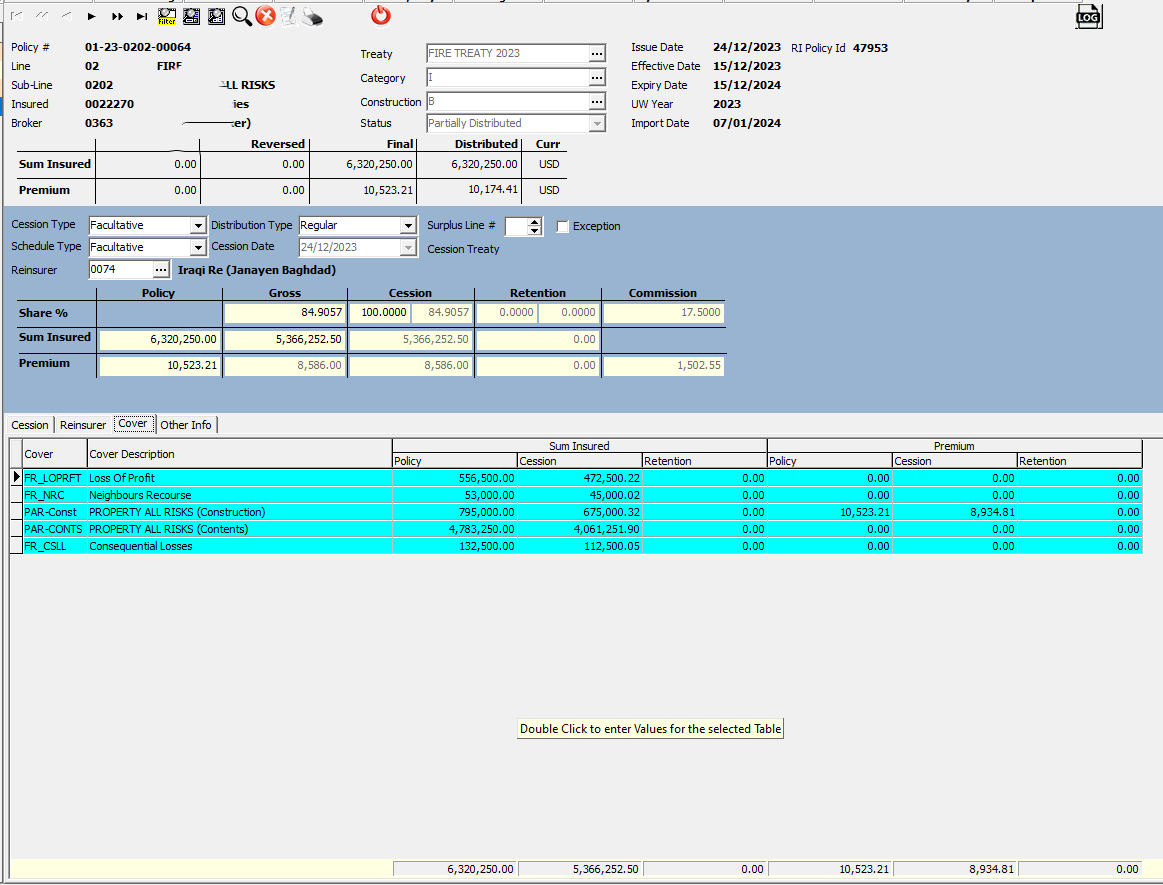

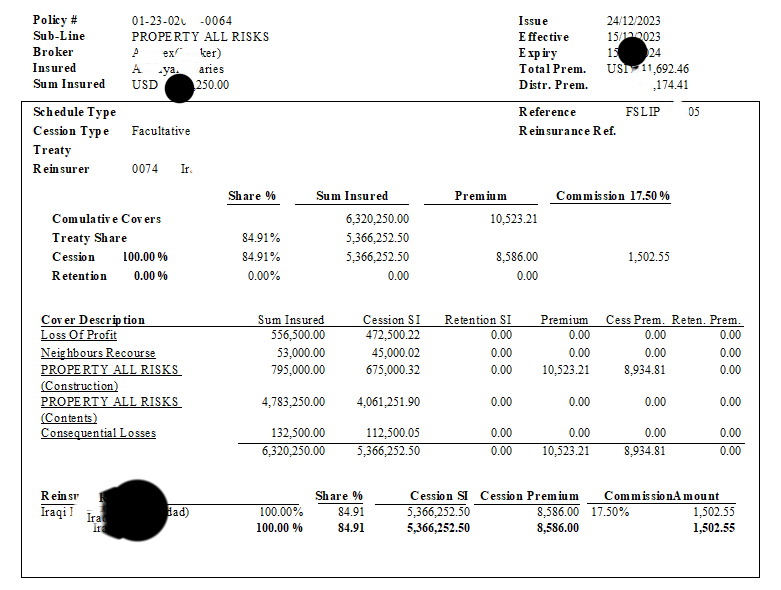

Reinsurance

Simplify reinsurance tasks with our module. Define treaties, and let the system automate risk distribution, ceded premium, and commissions. Receive warnings for incompletely distributed policies. Tailor your reinsurance strategy by excluding specific policies or lines of business, and easily manage special acceptances for treaty exceedances. Enjoy a streamlined reinsurance process with automated efficiency.

Enhance your reinsurance insights with detailed policy distribution, including covers and securities. Our module allows for comprehensive reporting, providing a nuanced view of risk distribution. With a single click, effortlessly generate detailed claims distribution reports within the reinsurance module, streamlining your decision-making process and providing a deeper understanding of your reinsurance portfolio.

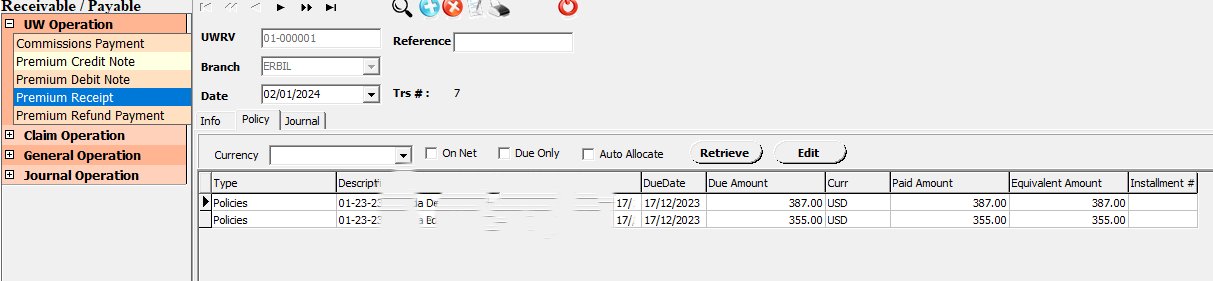

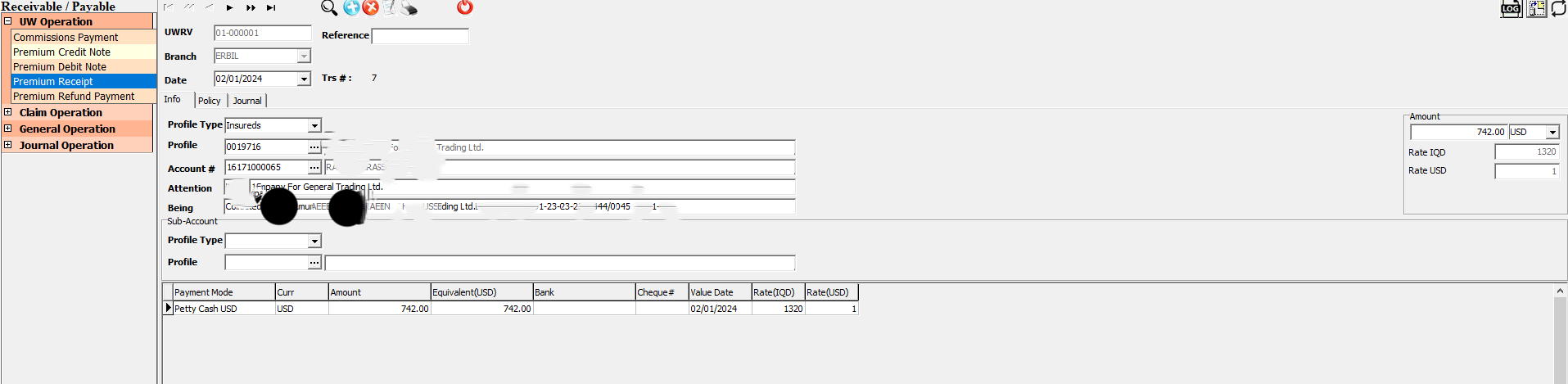

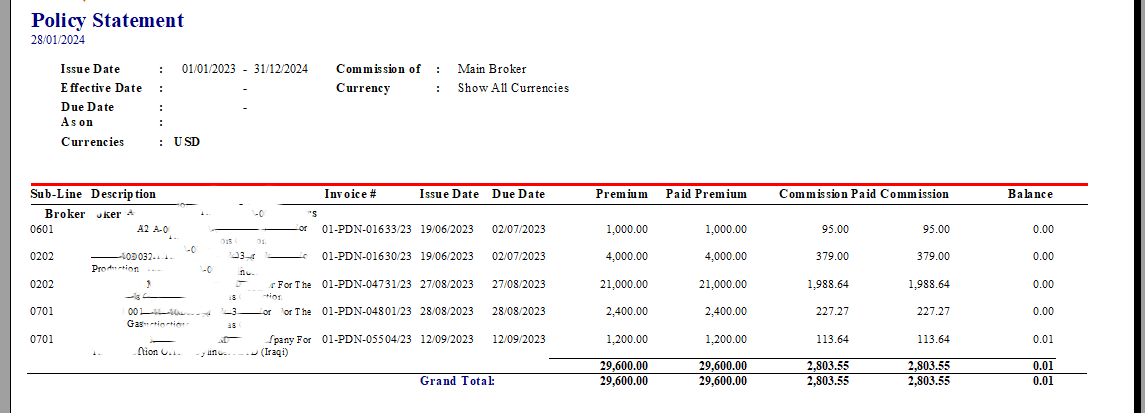

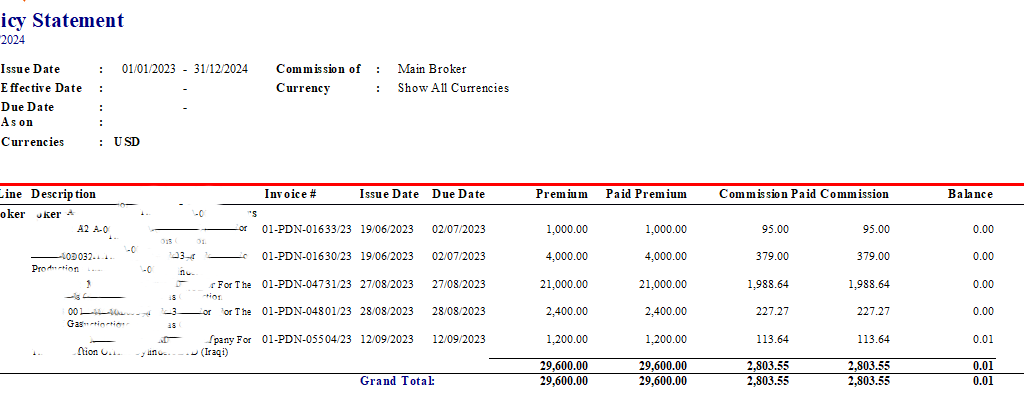

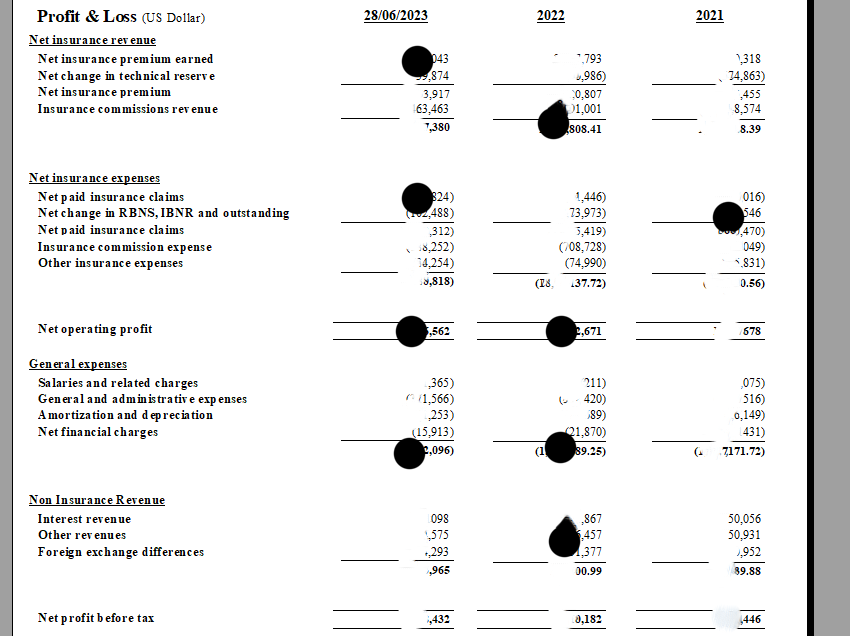

Accounting

Our accounting module offers versatility with various payment and receipt types, including claim payments, commission payments, refunds, premium receipts, general payments, and general receipts. Enjoy the flexibility of making installments and easily settle policies. Generate customized policy statement reports, providing detailed insights into policy settlements for comprehensive financial reporting and analysis. Streamline your accounting processes with precision and ease.

Ledger

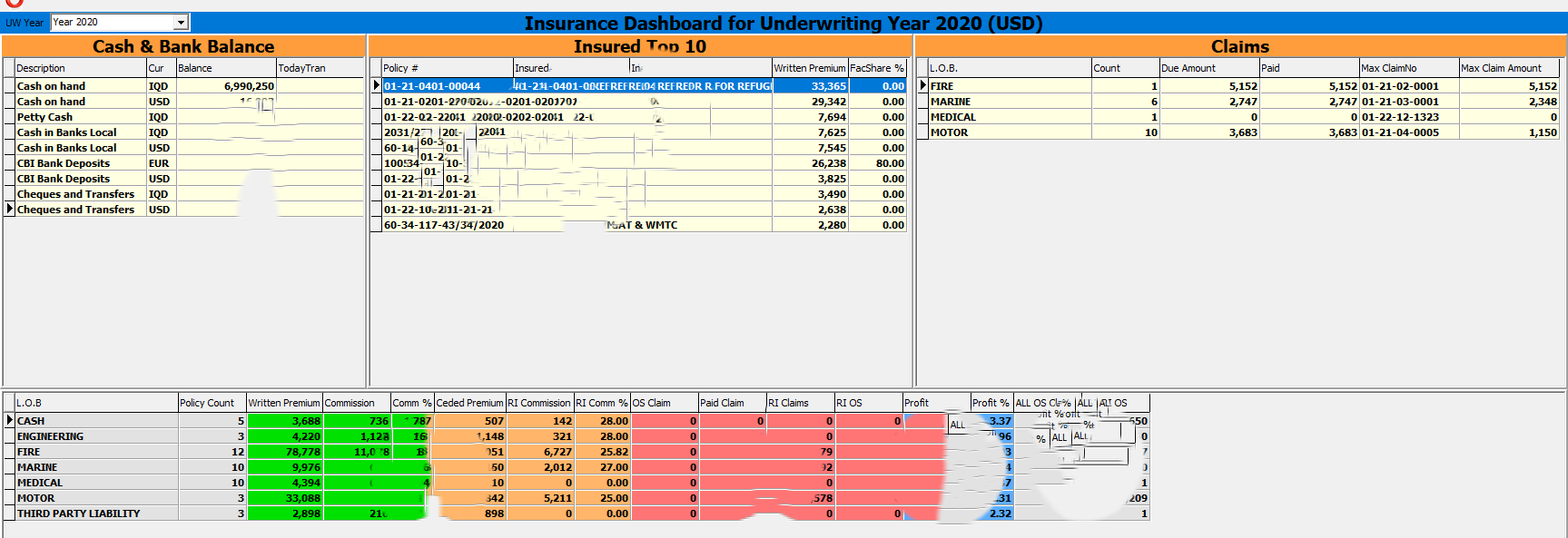

Unlock robust financial reporting with our Ledger module. Generate essential reports such as trial balance, income statement, balance sheet, and statement of account. Utilize a dynamic dashboard for real-time financial insights. Compare reports across different years to track performance trends and make informed decisions. Empower your financial management with comprehensive and easily accessible reporting capabilities.

Automate your financial processes with a one-click monthly ledger posting for production, claims, reinsurance, outstanding claims, and reserves. Streamline your accounting tasks, ensuring accuracy and efficiency in reflecting key financial transactions. This feature simplifies the month-end closing process, providing real-time insights into your insurance operations.

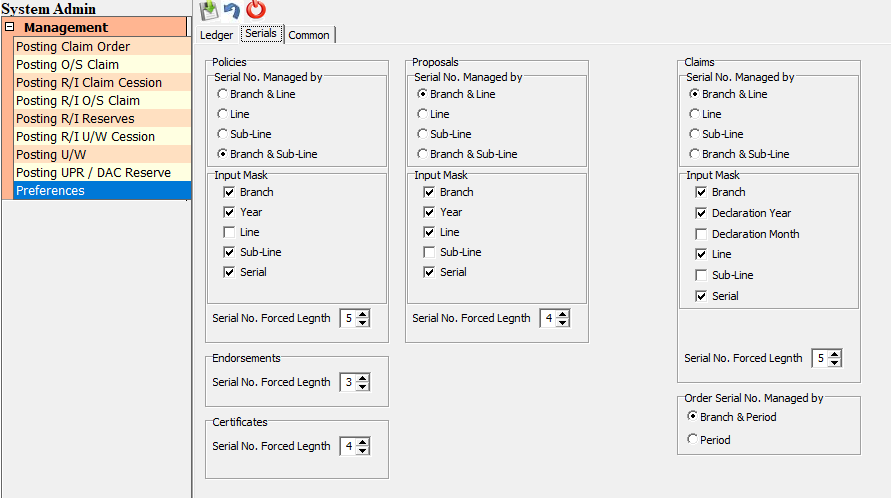

Security and Admin

In our security module, establish user groups with predefined access rights to specific modules. Admins have the authority to grant view, add, modify, or delete permissions for records. This granular access control ensures data integrity and confidentiality, providing a secure environment for managing and safeguarding sensitive information within your insurance software.

Reports

Our comprehensive insurance software offers a wide range of reports across all modules, ensuring satisfaction in data analysis and decision-making. Access detailed policy statements, financial reports like trial balance and income statements, dynamic dashboards, security access logs, and customizable reports for production, claims, reinsurance, outstanding claims, and reserves. Tailor your reporting to meet diverse needs, empowering you with valuable insights and control over your insurance operations.

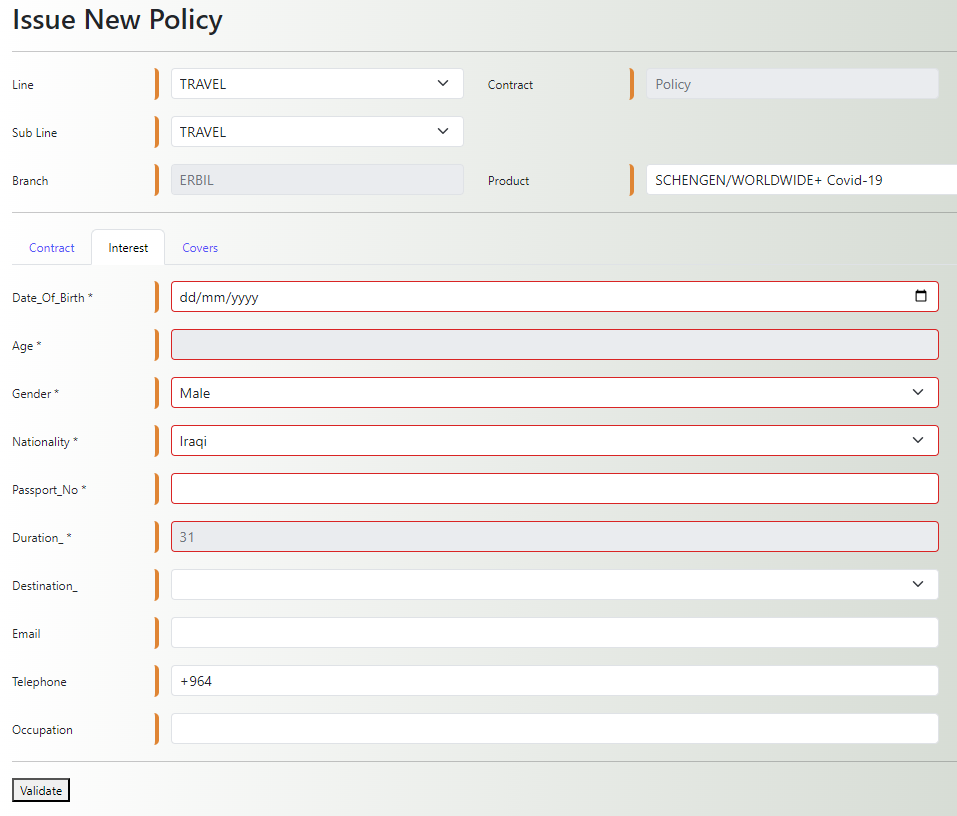

Online Platform

Facilitate seamless policy issuance with our online platform. Empower agents and brokers to generate policies efficiently through a user-friendly interface. Streamline the entire issuance process, from application submission to policy delivery. Enhance collaboration and provide a digital, accessible solution for your agents and brokers to optimize their workflow and improve customer service.